Transforming BMDF into a Generation‑II Municipal Financing Institution

Insights from the Organizational & Systems Capacity Building (OSCB) Study by IP3 Consulting

From Donor‑Dependent Projects to Sustainable Urban Finance

The Bangladesh Municipal Development Fund’s Role in Urban Development

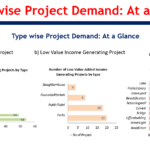

For over two decades, the Bangladesh Municipal Development Fund (BMDF) has delivered vital urban infrastructure projects across Bangladesh—improving roads, drainage, and public facilities for millions.

Findings from the OSCB Study

The OSCB team, led by IP3 Consulting, found that BMDF’s project‑based financing model—while effective—constrains its evolution into a self‑sustaining municipal financing institution.

Key Barriers Identified

- Governance ambiguity — Overlapping Board and management roles slow decisions: The BMDF Board and executive management have overlapping mandates, with both bodies involved in operational decision-making. This blurs accountability, slows down funding approvals, and often creates bottlenecks in project initiation. Without a clear separation of policy oversight from day-to-day execution, strategic decisions can become mired in procedural delays, limiting BMDF’s agility in responding to urgent municipal needs.

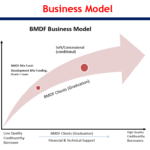

- Financial dependence — Heavy reliance on donor projects; limited own‑source revenues: BMDF’s revenue streams are overwhelmingly tied to donor-funded projects and concessional loans from development partners. While this has enabled decades of project delivery, it leaves BMDF vulnerable to shifts in donor priorities and global aid trends. The absence of independent revenue-generation mechanisms—such as interest spreads, service fees, or municipal bond facilitation—limits its ability to plan long-term or finance large-scale infrastructure independently.

- Capacity gaps — Missing HR policies, performance systems, specialist skills: The institution currently lacks structured human resource policies, competitive career progression paths, and performance-based incentives. Technical specialization in critical areas—such as credit risk assessment, municipal bond structuring, and PPP negotiation—is minimal. This hinders BMDF’s ability to innovate financial products, appraise complex projects, and meet international fiduciary standards required by potential private sector co-financiers.

- Legal limitations — Statutes don’t yet enable modern municipal finance instruments:

The BMDF Transformation Formula

Governance clarity + enforceable contracts + capacity‑anchored structure = sustainable municipal financing

Governance Clarity via Board–ManCom Separation

A dedicated Management Committee (ManCom) runs day‑to‑day execution under delegated authority, while the Board focuses on strategy and oversight.

Enforceable Credit Architecture

Government‑approved Sub‑Credit Agreements (SCAs) with explicit legal remedies secure loan recovery and reduce default risk.

Organizational Redesign

Two specialist divisions—Program and Organizational Development & Management (OD&M)—with internal audit and a cross‑divisional Training Cell build durable capability.

Advisory Legitimacy

A high‑level Advisory Board strengthens resource mobilization and donor confidence.

Choosing the Right Governance Model

Two transformation models were evaluated:

Non-Bank Financial Institution (NBFI) licensing – Offers loan recovery under the Artha Rin Adalat Ain but brings heavy regulation and high capital requirements.

PKSF-style governance – Maintains BMDF as a state-owned, guarantee-limited company, with modernized Articles of Association, operational autonomy, and a strong Board–management balance.

Recommendation: Adopt the PKSF-style governance model for its optimal mix of mission alignment, operational flexibility, and cost-effective compliance.

Why This Matters for Bangladesh’s Urban Future

With governance clarity, enforceable loan agreements, and a professionalized structure, BMDF can:

Accelerate decision-making, enabling faster disbursements and higher loan recovery rates.

Diversify funding sources, introducing pooled lending, public–private partnerships (PPP), and municipal bonds.

Enhance municipal capacity, improving project appraisal, urban planning, and local revenue generation.

Reduce reliance on donor aid, ensuring financial sustainability for long-term infrastructure development.

Expected Development Impact

- Faster decisions → increased disbursements and stronger recovery.

- Advanced tools → pooled lending, PPP co‑financing, bond facilitation.

- ULB capacity → stronger planning, appraisal, and revenue generation.

- Financial sustainability → diversified funding, reduced donor dependence.

IP3 Consulting’s Role

As lead technical partner, IP3 Consulting combines legal‑governance reform, municipal finance innovation, and operational design tailored to Bangladesh’s context.

Our approach ensures reforms are legally sound, financially viable, operationally executable, and socially responsive—positioning BMDF as a true Generation‑II municipal financing organization.

Want the full transformation roadmap?

Request the OSCB executive brief, implementation timeline, and performance KPIs.

Leave a Reply